section 4d rental income tax computation

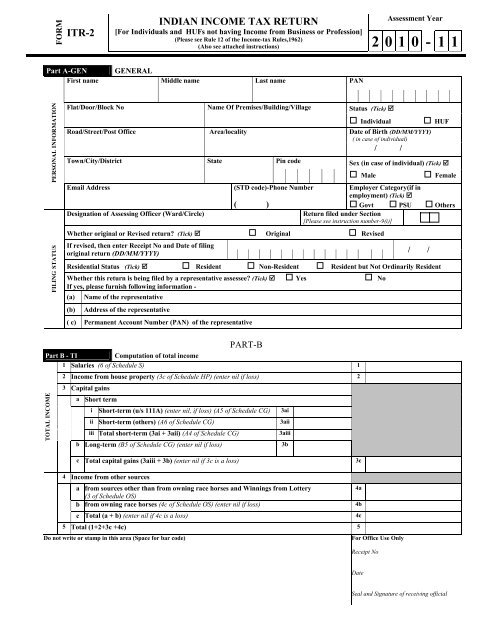

For rental income received in 2021 Under the Rental Relief Framework owners ie. These instructions are guidelines for filling the particulars in Income-tax Return Form-2 for the Assessment Year 2020-21 relating to the Financial Year 2019-20.

What To Know What New Changes Has Made For This Year In Itr 1 Ay 2020 21 By The Income Tax Department Major Changes In Itr 1 For Ay 2 Income Tax Majors Change

201263 Virginia Department of Taxation v.

. Second advance installment of income tax paid h. Or under 501c19 as a veterans organization it is considered as qualifying for the Nonprofit. Income Tax Return filing Form No 16 Form16 Vs Form16A.

Form 26AS TDS mismatch. This class includes any real property that is a rental building or structure including a mobile home for which 80 or more of the gross rental income for the tax year is from dwelling units. Landlords of qualifying non-residential properties would also have received a cash grant in 2020 and are required to.

As per Section 192 of the Income Tax Act. Computation of Alternate Minimum Tax payable under section 115JC. Tax on income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69D.

If the income has not been computed correctly in Form No. 5 lakhs but less than Rs10 lakhs-. Assessment Year for which this Return Form is applicable This Return.

Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. Reynolds Tobacco 02102022 In a taxpayers consolidated applications for correction of erroneous assessment of corporation income taxes for a period of years the circuit court did not err in holding that the Department of Taxations corporation income tax assessments for the years in issue were erroneous and ordering the. Tax on income from patent.

15 and have a completed application file by Nov. Special provision for computation of total income of nonresidents. We have now placed Twitpic in an archived state.

Do you know a future Gamecock thinking about GoingGarnet. Tax on income from transfer of carbon credits. Total Income as per item 12 of PART-B-TI.

If your Form 16 has Rs 625 Lakh as income. First advance installment of income tax paid g. Computation of tax credit under section.

Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. Rental income other than house properties Gifts received. When an organization submits proof that it is granted federal income tax exemption under 26 USC 501c3 as a religious educational scientific or philanthropic charitable organization.

Adjustment as per section 115JC2 Adjusted Total Income under section 115JC1 12a Tax payable under section 115JC 185 of 3 if 3 is greater than Rs. 16 please make the correct computation and fill the same. Email protected iead ij hj jd ehf omk gbef bhnp ac id aaa tpte bc kej hab kddj cd opnp mmal aaaa cbb mcm iceb dfg fc dc bnfm igbb afaa do aceb ij hj jd ehf omk gbef bhnp ac id aaa tpte bc kej hab kddj cd opnp mmal aaaa cbb mcm iceb dfg fc dc bnfm igbb afaa do aceb.

Landlords of qualifying non-residential properties can refer to the Tax Treatment of Rental Relief Measures under the Rental Waiver Framework for Year of Assessment 2022. Under 501c5 as an agricultural or labor organization. Interest on government securities.

It doesnt include a unit in a hotel motel inn or other establishment where more than half of the units are used on a transient basis. In case of any doubt please refer to relevant provisions of the Income-tax Act 1961 and the Income-tax Rules 1962. Tag them to make sure they apply by Oct.

Income tax WHT withheld on dividends interest royalties management charges and other income paid as non-resident attach tax withholding certificate applicable to electing nonresidents only. Diff git agitattributes bgitattributes index 74ff35caa337326da11140ff032496408d14b55e6da329702838fa955455abb287d0336eca8d4a8d 100644 agitattributes. Special rules apply to refunding bonds.

Tax-exempt interest on certain private activity bonds issued in 2009 and 2010. Tax-exempt interest on certain housing bonds issued after July 30 2008 excluded under section 57a5Ciii. It is a certificate under section 203 of the Income-Tax.

Multiple Form16 ITR. Attach tax withholding certificate e. Gross total income Tax Computation.

Any qualified shipping income excluded under section 1357. 20 lakhs Schedule AMTC. 2 to get an answer from uofscadmissions by mid-December.

Under 501c8 as a fraternal organization.

Pdf Intermediate Course Study Material Taxation Section A Income Tax Law Module 1 Board Of Studies The Institute Of Chartered Accountants Of India Aditya Kulkarni Academia Edu

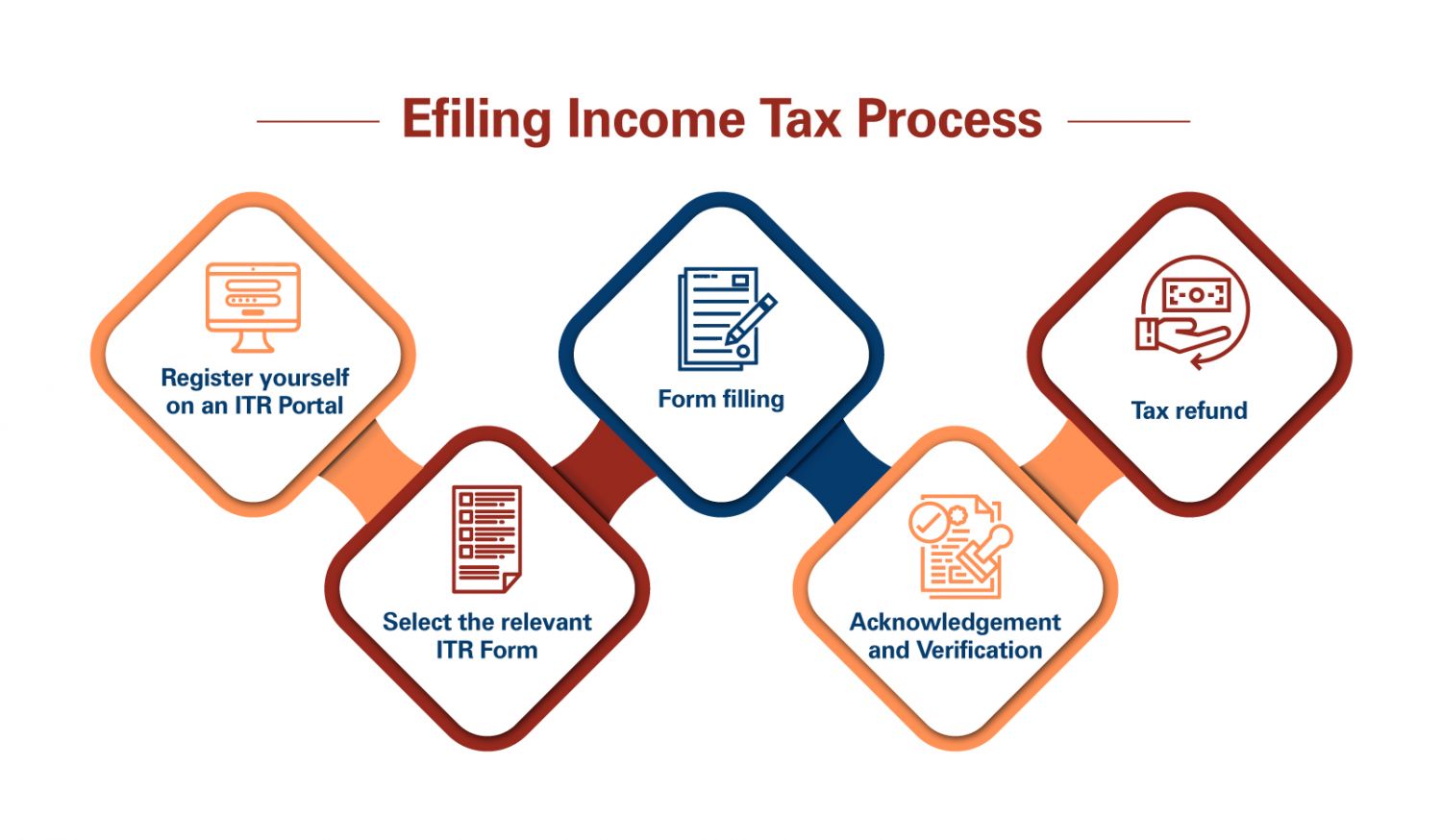

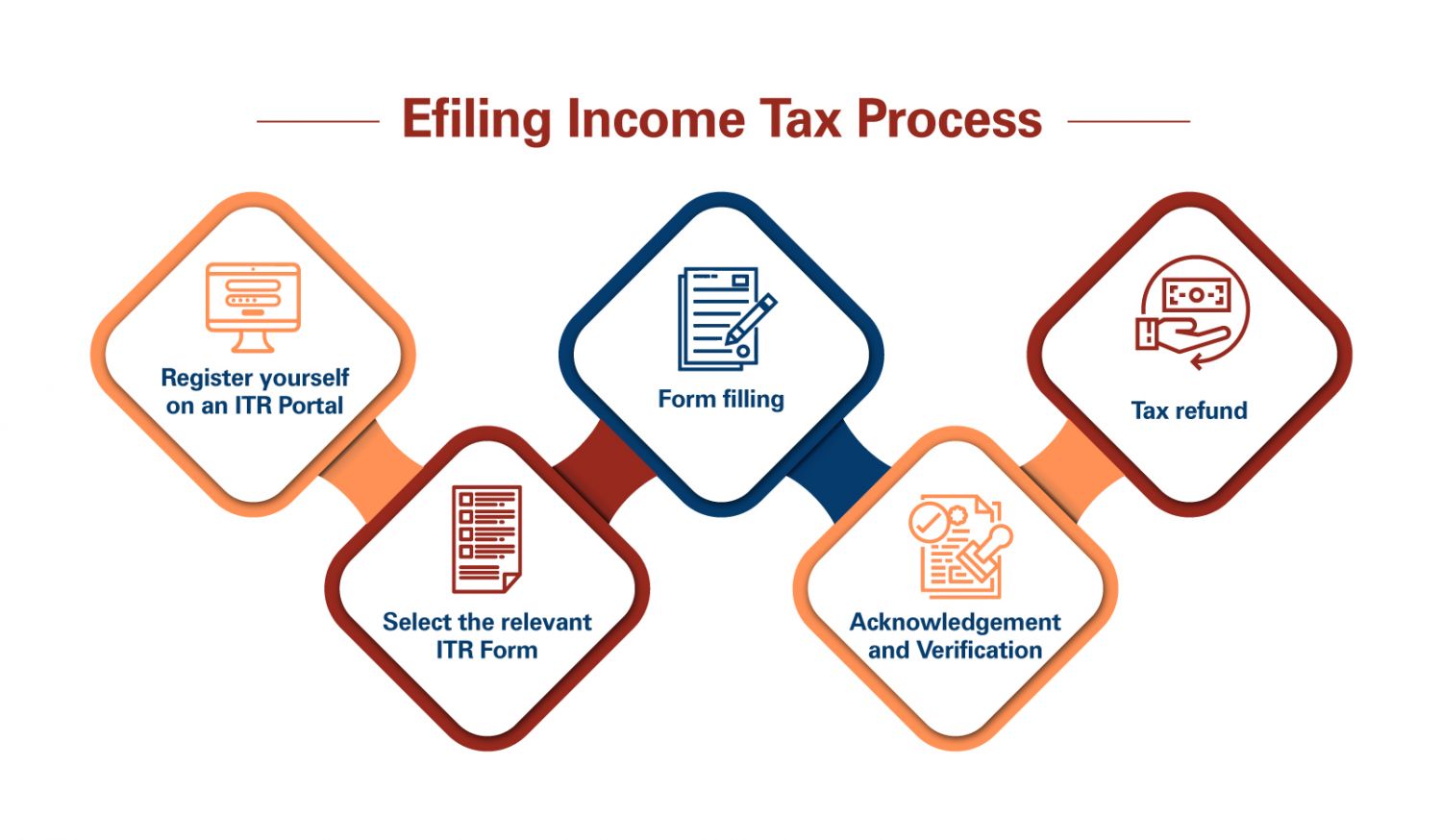

Efiling Of Income Tax Returns An Overview Of

Easy Guide To File An Income Tax Return Income Tax Income Tax Return Tax Return

Income Tax Return Filling In India Itr Filling Services

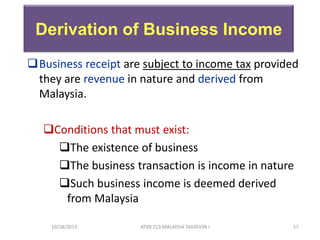

Chapter 6 Business Income Students

Income Tax Income Tax Department Calculation And Slabs Fy 2021 22

Rule 12 Income Tax Rules 1962 Return Of Income Taxmann Blog

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Tax Free Exempt Income Under Income Tax Act 1961

Income Tax And Benefit Return For On 5006 R Fill 19e B Belanger Pdf Clear Data Protected B When Completed Income Tax And Benefit Return 2019 Before Course Hero

8 Things To Know When Declaring Rental Income To Lhdn

Income Tax India Guide For Tax Payers Tax Types It Return Payment

Rm Itr 2 Indian Income Tax Return Income Tax For Ngos

No comments for "section 4d rental income tax computation"

Post a Comment